ATTENTION: For Those who are serious about Getting Pre-Qualified FAST!

Bill Rapp, Mortgage Originator: NMLS 228246

"Brokers Are Better.

Better Pricing, Better Service!"

Subscribe To My List Below To Get Your Mortgage Quote Now!

Simply enter your name and email below:

Bill Rapp The Mortgage Viking Programs:

Down Payment Assistance:

Mortgage Tax Credit:

Mortgage Tax Credit:

Offer

Accepted:

Offer Accepted:

Rate

Match:

Rate Match:

Get your interest rate matched with any other banks or companies.

Community

Heroes:

Community Heroes:

Fast Track

Closing:

Fast Track Closing:

Credit

Repair:

Credit Repair:

WITH PROVEN STRATEGIES & PROVEN RESULTS

HERE'S WHAT MY CLIENTS SAY:

What People Are Saying:

Excellent Service

Bill is an exceptional loan officer. He helped us to purchase our home with very personal and professional service. He helped us navigate the whole process from start to closing without any problems. We didn't think we're qualified to purchase a house, but Bill went above and beyond to find a way to help us achieve our goal. He always responded very quickly with our requests, he would come back with different options with comparison chart to clearly indicate how much we need for down payment, monthly payments, interest rates, closing costs etc.

We would highly recommend Bill to anyone in need of lending services. In fact, we have already recommended Bill to one of our friends on purchasing a house.

--- David Chan - Houston, TX

Bank Statement Lending!

William Rapp of Network Funding, L. P. was very professional and I felt comfortable in dealing with him. I will definitely recommend him to family and friends.

--- Ian F - Missouri City, TX

Professionalism - Expert In Home Style Loan

Bill is an expert in the topic, his explanations and online material make a difference and he is always there from the beginning to the end. He is committed to make thing happen.

--- Felipe Caldern & Carolina Angel Gutierrez

Great Service!

Bill Rapp's handling of our loan (even though out of state) was unparalleled to any service I have been through prior, including 3 different real estate transactions and multiple refinances. Extremely quick close, with great options and flexibility for my families needs. All around A+

--- Chris & Beth Sheehan - San Jose, CA

Knowledgeable and Responsive!

Bill was a pleasure to work with and he made the loan process fairly easy. He answered all questions I had very quickly and was straight forward in doing it. I would recommend Bill to others.

--- Wes Brady - Richmond, TX

Very professional and always returned our calls!

Bill takes a lot of pride in his job and is very dependable. They were very patient and understanding. He went out of his way and explained all my questions and concerns. They were very professional and returned my phone calls and emails. He did a great job and I fully recommend him.

--- Therese, Malcom & Shirley Teixeira - Katy, TX

Great Job!

Bill helped us out from beginning to end of loan process. The loan closed in a timely manner as Bill worked hard with bank to get our to the final steps.

--- Kamal & Theresa Wilson - Hartford, CT

Avid Problem-Solver and Absolute Pleasure to Work With!

Bill Rapp worked very hard to ensure that we closed our loan and were able to move into our new home. He always had alternatives to any problems we encountered while closing. He worked with us from the beginning identifying solutions to any problems that we were having. He was an absolute pleasure to work with!

--- Nikita Rayani & Sanit Tejani - Houston, TX

Awesome to work with!

Being a first-time buyer I came in with lots of questions and concerns. Bill was always available for any questions I had and answered everything to my satisfaction. Bill made the loan process so painless that I could still concentrate on other things. We ended up closing early which made things even better. If you are in need of a lender and want someone who is very approachable and stays on top of your loan then Bill is your guy.

--- Cesar Raya - Richmond, TX

Loan Declined by my bank, and he saved the day!

Bill, did an amazing job helping me close on my house. He took the reigns and reassured me the best route to take to help close. He was accountable, thorough and trustworthy. I will continue to work with Network Funding, L.P. when it comes to home buying in the future because of the quality of service Bill gave.

--- Jacob Smith - Boerne, TX

Bill Rapp Will Definitely Make It Happen!

Bill is the most kind, patient and helpful person I have ever known. He answers his phone calls and emails promptly. You can ask him a million questions, and he will answer each and every one of them. Before I started working with Bill, I had been turned down for a home loan, because of some past credit issues I had, plus I was a single mother. However, once I started working with Bill, he was able to quickly get me a home loan, with a good interest rate. I would recommend that you call him, as he will help you.

--- Corinne Wilson - Roselle, NJ

Knowledgeable, Honest, Trustworthy, and Reliable!

"I will definitely keep you in mind. If anyone I know needs financing, I will send them your way!"

--- Jon & Andrea Saleem, CRPC Financial Advisor - Houston, TX

Best Dam Mortgage Guy a man could know!

"Hands down the best loan experience to date!"

--- Gabe & Chelsea Jackson - Pearland, TX

Phenomenal, Hard Working and Never Quits!

Had a stupid foreclosure that could have been avoided if ex’s attny would have sent my buy out offer. So Bill was able to push this through with a 4 year foreclosure. He worked his butt off, was very diligent with his communication; and was very professional talking to me even when I was screaming and/or crying at him. Highly recommend this lender. He really go to the ends of the earth to help you!

--- Liz Keeter - Harlingen, TX

Exceptional customer service!

Bill is the most kind, patient and helpful person I have ever known. He answers his phone calls and emails promptly. You can ask him a million questions, and he will answer each and every one of them. Before I started working with Bill, I had been turned down for a home loan, because of some past credit issues I had, plus I was a single mother. However, once I started working with Bill, he was able to quickly get me a home loan, with a good interest rate. I would recommend that you call him, as he will help you.

--- Isha Lopez & Mauricio Garcia - Houston, TX

Service with a capitol S

Bill went above and beyond at every turn. He worked late on Saturday, he worked late all the time. We wanted to close ASAP and he really helped make it happen for us.

--- Jeff & Wendy Heger - Houston, TX

Best Buying Experience!

I would would highly recommend going with Network Funding LP. As a first time home buyer I didn't know what to expect. Bill Rapp was very helpful in answering all my questions and guided me through all ghe steps. I couldn't have asked for a better buying experience!

--- Tabitha Turner - Humble, TX

Would recommend him and use him again!

Very involved and professional . Kept me informed and up to date on everything that was going on Went with me closing and was very helpful and knowledgeable.

--- Kathy Ward - Houston, TX

Great experience!

Well I meet bill back in December 2016 he got recommended by my real estate agent we had a house in sight and started the process to get approved but we fail due to my work history and credit bill told me not to give up and put me in contact with a credit repair company they help me bring my score up and bill walk me thru the process of getting a new line so this time around we got approved before looking for our house after we found it we still had a couple of hick up but with bills help on Sunday 6-18-17 to be exact Father's Day bill called me to give me the great news that we had got approved and the closing date was as scheduled bill was more than just a lender to my family he became a friend and I'm alway going to have him in mind for any other financial situation.

--- Alejandres Felimon - Richmond, TX

I really liked his attitude!

I wouldn't usually say this but the way he had handled my mortgage was really pleasant. I personally enjoyed the time spent with him while we discussed feasible rates. He's a great man with a great personality and he offered really low interests as well. Definitely recommend him to others.

--- Tom Troiano - Atlantic City, NJ

He's nothing short of a miracle!

I'm a self-employed businessman and had him figure out the mortgage of the house after 30% down payment. The interest rates I received were incredibly low given what I had thought of earlier. One other important thing to note was that I hadn't really taken any loans earlier, so I had no credit history. He helped me out with all that as well so I can't really call him anything else but a miracle.

--- Fran Suarez - Cleveland, OH

He's really helpful!

I made a bid to him and the very same day he gave me an offer which I couldn't resist. It was too intimidating with those incredibly low interest rates and all, thoroughly recommend him.

--- Kenny Mickle - Houston, TX

Expeditious!

Bill was very expeditious and made it real easy going through the loan process. I felt he was on top of things.

I deal with investment properties and will more than likely call on him again.

--- Wayne King - Pensacola, FL

Bill was great!

Bill made us feel like a friend all the way thru the process. He was patient and explained everything he needed clearly. He was available ANYTIME we had questions or needed more information. Hopefully we won’t go thru this process again anytime soon, but if we do - we’d choose Bill! =)

--- Barbra & Nick Grimmer - Austin, TX

Great broker!

Bill was a great broker to work with. As first time home buyers we had many questions about the process, Bill took the time to help us even calling us back on weekends with answers. I would not hesitate to recommend him to anyone looking for a broker to work with.

--- Murray & Lisa Turner - Pensacola, FL

Outstanding service!

I couldn't have been more pleased with Bill's level of service. He made what is typically a lengthy, arduous process far quicker and easier at every turn. I'm extremely comfortable recommending Bill to friends and family, and will definitely utilize his services again!

--- Jim Lipari - Austin, TX

RESOURCES & LINKS... Click Any Below

Renovation Mortgage Specialist

Two little-known home renovation mortgage programs offer solutions for buyers and homeowners who want to renovate.

Fannie Mae and the Federal Housing Administration have home renovation mortgage programs that allow buyers to borrow based on what the house is expected to be worth after the home rehab is completed. Homeowners can also use both programs to refinance their existing mortgage plus the renovation costs into one loan.

FHA's 203(k) program and Fannie's HomeStyle Renovation Mortgage have been around for years. In the old days -- when most borrowers could easily get second mortgages or generous credit lines to pay for renovations -- these loans weren't as appealing as they are today.

Home renovation loans are in Demand !

"A couple years ago, there wasn't as much demand for these loans," says Bill Rapp, a senior loan originator with Network Funding in Houston, who specializes in renovation mortgages. Demand surged in the aftermath of the housing crisis, when borrowers saw them as a way to buy and renovate distressed properties.

How it works Unlike credit lines, these renovation loans require borrowers to show that the money was spent on the house. In the standard FHA 203(k) program, the borrower hires a consultant to assess the construction plan and to perform an inspection before each draw is made. A "draw" happens when a portion of the money is disbursed to the contractor. Borrowers have up to six months to finish the project and are allowed up to five draws. The HomeStyle program does not require a consultant to monitor the work, only an initial and final inspection.

Great for foreclosure hunters !

While rehab loans involve more work than traditional mortgages, they can be a great tool for those who want to buy discounted homes that need repair.

Bill Rapp says he helped a couple who bought a foreclosed house in Houston, TX for $26,000 and borrowed $136,000 to renovate the property. An appraisal estimated the home would be worth about $135,000 after the work was completed. The couple was able to take out an FHA 203(k) mortgage totaling $144,000, which covered the price of the house, renovations, and loan costs, minus a down payment.

But how do you know which loan is best? It depends on the situation.

203(k) vs. HomeStyle .

Those who don't have great credit should probably opt for an FHA 203(k). Most Fannie Mae HomeStyle lenders require a credit score above 660. To get the best rate on a HomeStyle mortgage, borrowers need to have a minimum 740 credit score, Bill Rapp says.

"If you have a 740 score and 10 percent down, a HomeStyle is definitely cheaper," she says. That's because FHA mortgages carry higher mortgage insurance premiums for borrowers who put the least amount down. FHA 203(k) home renovation mortgages have an upfront fee that is rolled into the loan amount. Less-than-stellar credit For borrowers with credit scores lower than 740, it's best to compare estimates, Bill Rapp says.

FHA does not set a minimum score requirement for 203(k) loans, but many lenders require a score of 640 or greater. There are a few exceptions, and some lenders accept scores as low as 580, Bill Rapp says.

Under the FHA's 203(k) program, borrowers can get a mortgage with a down payment as little as 3.5 percent. HomeStyle requires a minimum 5 percent down payment.

The FHA 203(k) program is available only for owner-occupants. The HomeStyle program allows investors.

How much do you need?

Another key factor a borrower should consider when deciding whether to go with a 203(k) or a HomeStyle home renovation mortgage is the size of the loan.

The 203(k) rehab mortgage has to comply with FHA loan limits. The limit varies by county but is $314,827 in most places. In high-cost areas, the limit is as high as $765,525.

You may be able to borrow more with the 203(k) than with HomeStyle if you are borrowing up to the local loan limit.

With a 203(k) loan, borrowers can get up to 110 percent of the home's appraised value, compared with 95 percent with a HomeStyle loan. Both appraisals are based on what the house is expected to be worth after repairs.

What do you want to fix?

FHA's 203(k) rehab loan does not allow borrowers to use the money for luxury items such as adding a swimming pool or a spa, but HomeStyle does.

Borrowers can opt for a streamline FHA 203(k) home rehabilitation loan if they need less than $35,000 and don't have to do any structural repairs or major landscaping work. The streamline 203(k) is similar to a standard 203(k) but is easier to get and involves less paperwork and less bureaucracy, Bill Rapp says. Streamline loans don't require the borrower to hire a consultant.

Call Bill Rapp, The Mortgage Viking, today to discuss your options 281-222-0433.

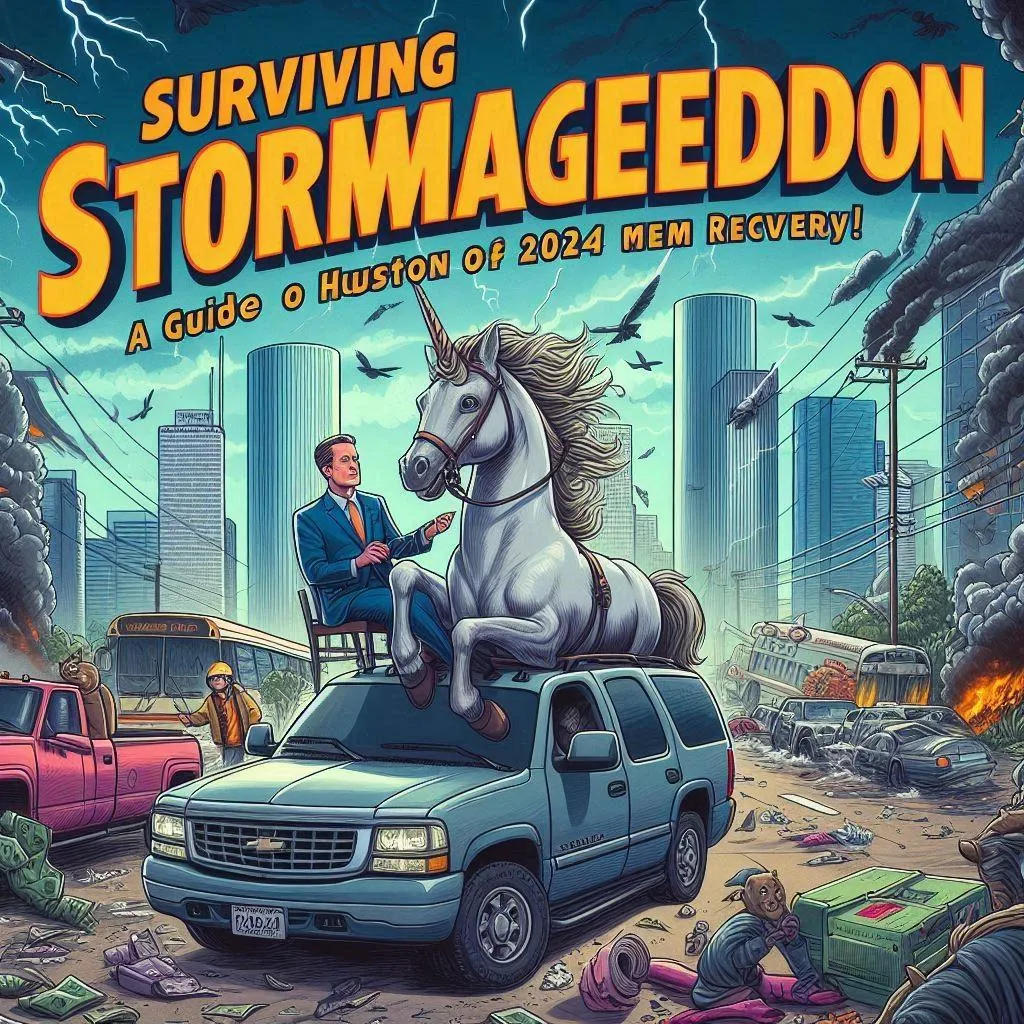

Surviving Stormageddon: A Guide to Houston's 2024 Storm Recovery!

Surviving Stormageddon: A Guide to Houston's 2024 Storm Recovery!

Tips for Filing Insurance Claims and Hiring Contractors After Houston's Recent Storms

Houston, a city accustomed to unpredictable weather, recently faced another bout of severe storms. These natural events can wreak havoc on homes and properties, leaving behind a trail of damage. If you find yourself in the unfortunate situation of dealing with storm-related damage to your property, navigating the insurance claim process and finding a trustworthy contractor can feel daunting. In this blog post, we'll provide guidance on how to effectively file an insurance claim and locate reputable contractors to restore your home back to its pre-storm condition.

Understanding Your Insurance Policy:

Before diving into the claims process, it's crucial to understand your insurance policy. Different policies may cover various types of storm damage, such as wind, hail, or flooding. Review your policy carefully to determine what is covered and what isn't. Additionally, take note of any deductibles and coverage limits that may apply to storm-related claims.

Documenting the Damage:

As soon as it's safe to do so, document the damage to your property thoroughly. Take photographs and videos from multiple angles to provide clear evidence of the extent of the damage. Make a detailed list of all affected areas and items within your home. This documentation will be essential when filing your insurance claim and can help ensure you receive proper compensation for repairs.

Filing an Insurance Claim:

Contact your insurance company as soon as possible to report the damage and initiate the claims process. Be prepared to provide detailed information about the damage, including when it occurred and its cause. Follow any specific instructions provided by your insurer and keep thorough records of all communication related to your claim. It's essential to act promptly, as some insurance policies have deadlines for filing claims after a storm.

Tips for Filing a Successful Claim:

1. Be thorough and honest when documenting the damage.

2. Keep all receipts and invoices for expenses related to temporary repairs or accommodations.

3. Don't make permanent repairs until your insurance company has assessed the damage.

4. If you're unsure about any aspect of the claims process, don't hesitate to ask questions or seek clarification from your insurance provider.

Finding a Reputable Contractor:

Once your insurance claim is approved, finding a reputable contractor to repair the damage becomes the next priority. Here are some tips for locating a trustworthy contractor:

1. Seek Recommendations: Ask friends, family, and neighbors for recommendations based on their experiences. Personal referrals can be valuable in finding reliable contractors.

2. Check Credentials: Verify that the contractor is licensed, bonded, and insured. Look for certifications or memberships in professional associations, which can indicate a commitment to quality workmanship and ethical business practices.

3. Get Multiple Estimates: Obtain estimates from several contractors before making a decision. Compare pricing, timelines, and the scope of work outlined in each proposal.

4. Read Reviews: Research contractors online and read reviews from previous clients. Pay attention to feedback regarding communication, timeliness, and the quality of work performed.

5. Ask for References: Request references from the contractor and follow up with past clients to inquire about their satisfaction with the work done.

6. Get Everything in Writing: Once you've selected a contractor, make sure to get a detailed written contract that outlines the scope of work, timeline, payment schedule, and any warranties or guarantees provided.

Conclusion:

Dealing with storm damage can be a stressful experience, but knowing how to navigate the insurance claim process and find a reputable contractor can make the recovery process smoother. By understanding your insurance policy, documenting the damage, and following the tips provided, you can increase the likelihood of a successful outcome and restore your home to its former glory. Remember, patience and thoroughness are key as you work towards rebuilding after the storm.

Should you need an experienced Commercial Real Estate Mortgage Broker, please feel free to contact me at 281-222-0433.

https://medallionfunds.com/bill-rapp/

https://www.billrapponline.com/

https://houstoncommercialmortgage.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com/

https://www.smartbizloans.com/partner/vikingenterprisellc/bill

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

Start your own blog checklist:

Here is a quick checklist to get you started with you website blow. Remember imperfect action beats inaction, get started and keep publishing.

Create your blog page then add the blog element

Add the blog element to your page and select if you want compact or list view

Start planning your blog topics by Identifying what resonates with your audience. If you are stuck you can use sites like - https://answerthepublic.com/

Create an outline serves your company goals.

Write conversationally, like if you were telling a story to a friend

Pick a catchy title.

Use several media types (gif, short video, or image) to deliver your messages.

Use data to back up claims or ideas - make sure to cite all sources❗

Have a call to action and or give your audience something to walk away with.

Take 30 minutes to edit your post.

Main Office:

Medallion Funds

bill@medallion-partners.com

11920 Southern Highlands PKWY Suite 302Las Vegas, NV 89141

Texas Complaint and Recovery Fund Notice

All Rights Reserved Copyright © 2021 - Bill Rapp The Mortgage Viking | NMLS #228246